Expert tips to take your business to the next level

Aug 05, 2022

When you run a small (or tiny) business on the side, it can be tricky to know what cash is available for yourself and what to set aside for tax. In this case study, we are going to look at a start-up business, that wanted to set up Profit First from the start.

Let's call her Jane.

Jane set up a new business as a company, because she already had a high income, and didn't want the profits to go on top of her other income. She had heard about profit first and how she could figure out by using the percentages how much her business could pay her.

She set up a website with some resources to sell but also did some consulting work as well, so had invoices to send. She decided to go with Xero for her bookkeeping, and as it was a new business, set up her 5 bank accounts with her bank, and linked all of the bank feeds through to Xero.

Her income was small to start off with, but so were her costs - cover the web hosting and the Xero subscription each month. Anything extra was then to be divvied up into taxes, profit and to take some out for herself.

We knew her costs were approx $250 per month (depending on the exchange rate to USD), so we knew that with profit first, we could work out what the total income needed to be to cover those costs.

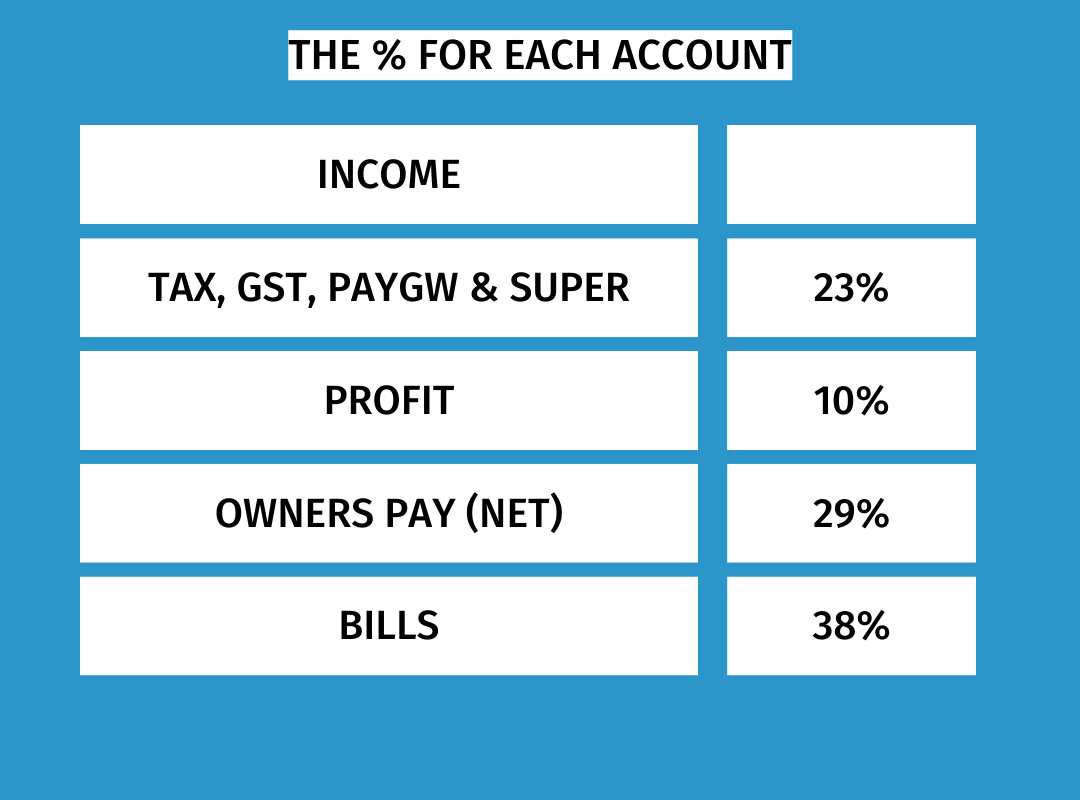

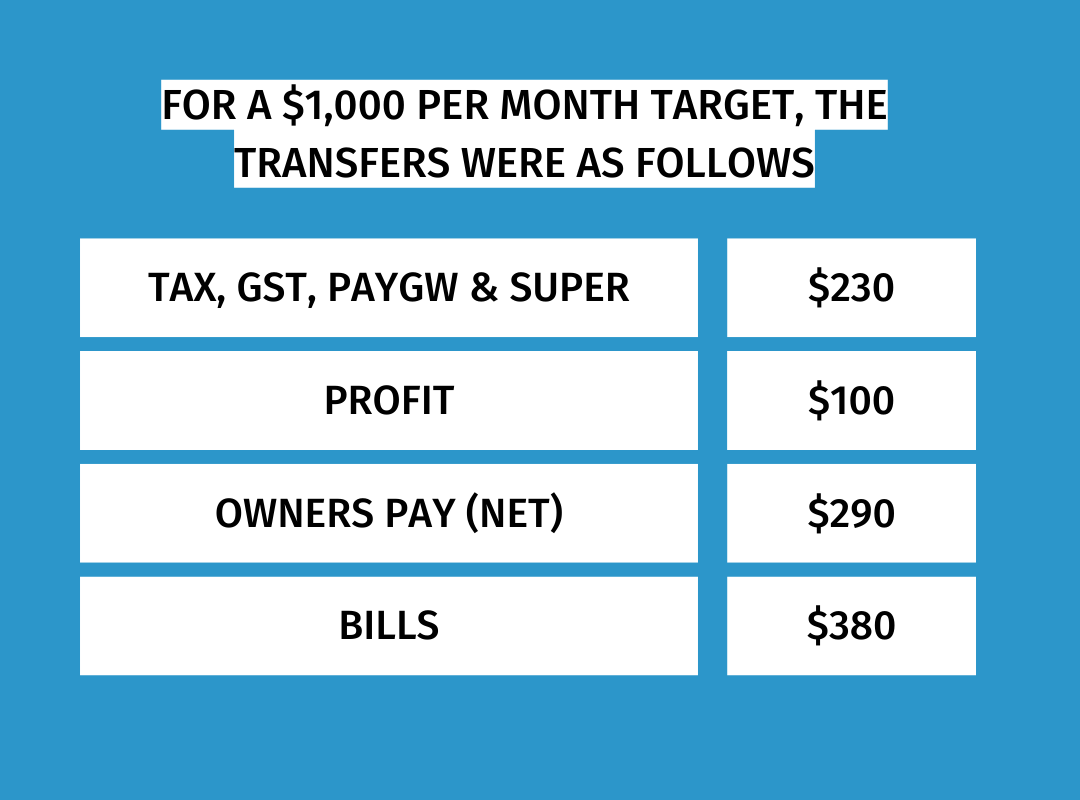

So with these percentages, we know that $250/38% = $657 per month had to be income. This would then cover the immediate monthly subscriptions. But there are other bills for the business as well, like insurance and accounting fees, so realistically the business needed to earn $1000 per month to cover its costs for the year.

What does this look like from a cashflow point of view, using the above percentages?

Jane was paid $290 in the hand for each month, plus she knew that all of the taxes and super were covered by the business. No stress. Plus, the business is making a profit of $100 per month - in cash, in the bank.

At the end of each quarter, the money in the profit account would go to 3 different places:

10% to donations

40% to owners pay (to pay as a bonus)

50% into the "Rainy Day fund", just in case sales dropped off and the bills needed to be paid for the month. A maximum of $250 could be withdrawn over 2 months - meaning that her butt needed to get into gear and sell more if the bills couldn't be paid on time.

So Jane gets a bit more of a bonus at the end of the quarter, just for making a profit - an extra $120 in the hand.

If you are familiar with Profit First, you might note that these percentages are not the "Target Allocation Percentages" that are outlined in the book. This is because Jane hates to owe taxes, so has lots more put aside for taxes, super, GST and PAYGW all in the same account. Although there is a buffer in this account and it looks quite healthy, she also knows that the business is making a profit and will need to pay income tax at the end of the year - and this is saved and ready for the accountant to let her know how much to pay. If there's more tax money than the tax bill after it's paid, we can then decide to reduce the tax % for transfers or choose to relocate some of that money to profits.

For a small business like this, the owner's pay is set at 50% in the Target Allocation Percentage - but out of this all taxes and super needs to be paid too. For Jane, this didn't make sense, she just wanted to take the money out that belonged to her (another reason why taxes is higher - it is relocated from owner pay).

When Jane's business starts earning more than $1000 per month, then she will see more money going into each of the accounts, topping them all up. By logging into internet banking, Jane can see what she has available to pay herself and make sure that her bills are covered. If there's not enough, then she can get to work selling her resources.

When it comes to bookkeeping, Jane logs into Xero every couple of weeks to process the transfers - Xero has an easy-to-use "transfer money" rule so that it is with the click of one button in each bank account that reconciles the transactions.

We hope that the above information will assist you in establishing your best Profit First structure to suit your business and personal circumstances. While following these guidelines, you have the flexibility to add other accounts.

SUBSCRIBE FOR WEEKLY LESSONS

We hate SPAM. We will never sell your information, for any reason.